Balanced Fund

Overview

The Green Century Balanced Fund provides individuals with a way to invest in stocks and bonds in one mutual fund. The Green Century Balanced Fund keeps your dollars out of fossil fuel companies and other environmentally harmful companies so your investment can align with your environmental values.

The Balanced Fund is actively managed and has the majority of its fixed income portion in green bonds, which finance efforts to mitigate the impacts of climate change, protect water sources, and improve soil conditions around the globe.

Objective

The Green Century Balanced Fund seeks capital growth and income from a portfolio of stocks and bonds which meet Green Century Fund standards for corporate environmental responsibility.

Balanced Fund Investment Strategy

The Balanced Fund is an actively managed fund comprised of equities and fixed-income securities. It typically holds 60% to 75% of its net assets in multi-cap stocks and 25% to 40% in investment-grade quality bonds. The Green Century Balanced Funds seeks to invest in well-managed companies.

The Balanced Fund also gives retail investors access to an institutional quality investment process from Trillium Asset Management, a leader in socially responsible investing since 1982 (See Portfolio Managers).

Environmentally Responsible Strategy

The Green Century Balanced Fund has avoided investing in coal, oil, and gas companies since 2008. It also does not invest in other environmentally harmful industries including tobacco, nuclear energy, factory farms, genetically modified organisms (GMOs), and nuclear weapons.

The Balanced Fund was an early investor in green bonds and now has over 73% of its fixed-income portfolio in green and sustainable bonds.1

A sustainable investment strategy that incorporates environmental, social, and governance criteria may result in lower or higher returns than an investment strategy that does not include such criteria.

Fund Facts

Inception Date:

March 18, 1992

Symbol and CUSIP:

Individual Investor Share Class: GCBLX, 392768107

Institutional Investor Share Class: GCBUX, 392768701

Minimum Investment/Fund:

Individual Investor IRA Account: $1,000

Individual Investor Regular Account: $2,500

Institutional Share Class: $250,000

Sales Charge:

No Load Fund

Front End Load: None

Back End Load: None

12b-1 Fee: None

Expense Ratio:

Individual Investor Share Class: 1.46%

Institutional Investor Share Class: 1.16%

Redemption Fee: 2.00% (on shares sold within 60 days of purchase)

Resources

- Fact Sheet - 3/31/2024 (PDF)

- Green Bonds Fact Sheet (PDF)

- March 31, 2024 Holdings (PDF)

- Prospectus (PDF)

- All Fund Distributions

- Account and Investing Forms

- Contact Information

Portfolio Characteristics

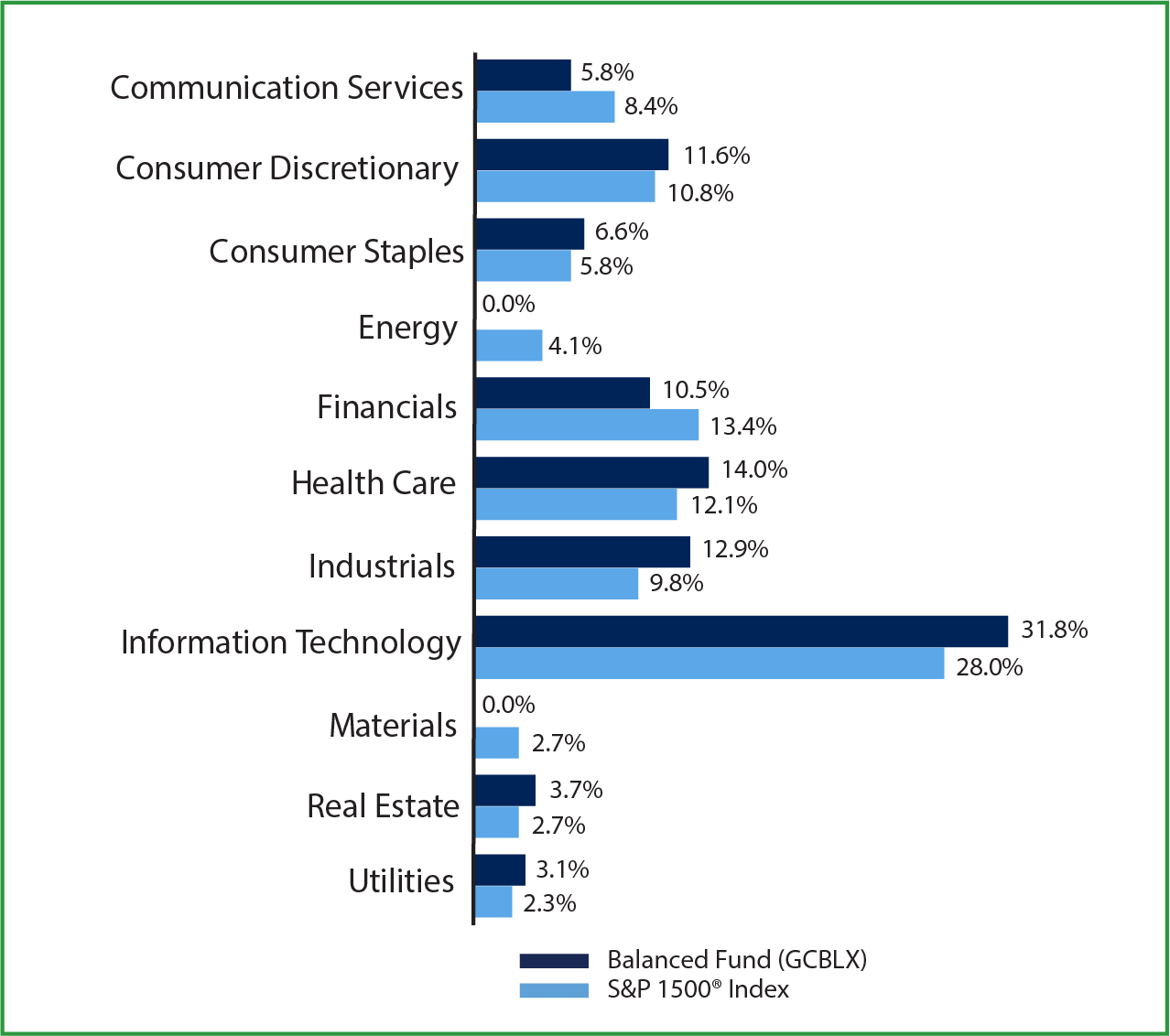

Balanced Fund Sector Allocation

As of 3/31/24:

10 Largest Holdings

As of 3/31/24: (23.17% of net assets)

You can also view the complete holdings of the Balanced Fund here.

Balanced Fund Asset Allocation

As of 3/31/24:

Total Net Assets: $394.26 million

Individual Investor Net Asset Value per Share: $35.03

Institutional Investor Net Asset Value per Share: $35.16

Common Stocks: 60.40%

Bonds: 36.47%

Cash and Equivalents: 3.13%

Performance

Performance is calculated after fees.

*Institutional shares were offered as of November 28, 2020. The Institutional Share Class performance for periods prior to November 28, 2020 reflects the performance of the Fund's Individual Investor Class.

The total annual operating expense ratios of the Balanced Fund Individual Investor Share Class and Institutional Share Class are 1.46% and 1.16%, respectively, as of the most recent prospectus.

The performance data quoted represents past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 1-800-934-7336. Performance includes the reinvestment of income dividends and capital gain distributions, if any. The performance shown does not reflect the deduction of taxes that a shareholder might pay on any Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus (PDF) for more information.

Daily Fund Price as of 04/26/2024

| Fund | N.A.V. | $ Change |

|---|---|---|

| Green Century Balanced Fund - Individual Investor Share Class (GCBLX) | $34.34 | +$0.31 |

| Green Century Balanced Fund - Institutional Share Class (GCBUX) | $34.47 | +$0.31 |

Portfolio Managers

Balanced Fund Investment Advisor: Green Century Capital Management

Investment Sub-advisor and Portfolio Manager: Trillium Asset Management

Green Century provides the investment advisory services to the Balanced Fund, including overseeing the daily portfolio management of the Fund by Trillium Asset Management. Green Century also coordinates the operations and the compliance functions for the Fund, as well as the shareholder advocacy efforts.

Trillium Asset Management is the sub-advisor to the Balanced Fund providing day-to-day portfolio management of the Fund since 2005. Trillium has been a leader in responsible and sustainable investing for over 30 years. A team of three portfolio managers at Trillium has responsibility for the day-to-day management of the Balanced Fund.

Matthew W. Patsky, CFA

Matthew Patsky, CFA joined Trillium in October 2009 as CEO, and has over 25 years of experience in investment research and investment management.

Matt began his career at Lehman Brothers in 1984 as a technology analyst. In 1989, while covering emerging growth companies for Lehman, he began to incorporate environmental, social and governance factors into his research, becoming the first sell side analyst in the United States to publish on the topic of socially responsible investing in 1994. As Director of Equity Research for Adams, Harkness & Hill, he built that firm’s powerful research capabilities in socially and environmentally responsible areas such as renewable energy, resource optimization, and organic and natural products. Matt was most recently at Winslow Management Company in Boston, where he served as director of research, chairman of the investment committee and portfolio manager for the Green Solutions Strategy and the Winslow Green Solutions Fund.

Matt is currently on the Boards of Environmental League of Massachusetts, Shared Interest, and Pro Mujer. He recently served on the Boards of US SIF and Root Capital. Matt is a member of the Social Venture Network (SVN). He is a Chartered Financial Analyst charterholder and a member of the CFA Institute. Matt holds a Bachelor of Science in Economics from Rensselaer Polytechnic Institute.

Cheryl I. Smith, Ph.D., CFA

Cheryl Smith, CFA and Ph.D. in Economics, has been with Trillium for over 20 years and has over 25 years of experience managing socially responsible institutional and individual portfolios. She began her investment management career at Trillium in 1987. In 1992 she joined United States Trust Company in Boston (now known as Walden Asset Management) as Vice President and portfolio manager, before rejoining Trillium in the fall of 1997.

Cheryl is currently a Board member of Oikocredit USA, and on the Steering Committee for the Institute for Responsible Investment. She is immediate past chair of US SIF and current member of its Policy Committee, and she recently served on the Board of Episcopal Divinity School. Cheryl is a Chartered Financial Analyst charterholder and a member of the CFA Institute. She is a member of the American Economic Association. Cheryl holds a B.S.F.S. degree from Georgetown University School of Foreign Service, and earned M.A., M. Phil., and Ph.D. degrees in Economics from Yale University.

Paul A. Hilton, CFA

Paul Hilton, CFA, has been with Trillium since 2011 and has 18 years of experience in the investment industry. Prior to joining Trillium, he was Vice President of Sustainable Investment Business Strategy at Calvert Investments and also previously held senior positions within Calvert’s Equities and Marketing Departments. Paul also served as Portfolio Manager for Socially Responsible Investing at The Dreyfus Corporation, then a division of Mellon Bank, and as a Research Analyst in the Social Awareness Investment (SAI) program at Smith Barney Asset Management, then a division of Citigroup. Paul started his career as an Analyst with the Council on Economic Priorities, a non-profit known for an influential consumer guidebook called “Shopping for a Better World.”

Paul is former Board Chair of US SIF, former Treasurer of the United Nations Environment Programme Finance Initiative (UNEP-FI), and founder of the Social Investment Research Analysts Network (SIRAN), the first U.S. network of sustainability analysts. A member of CFA Society Boston and a Chartered Financial Analyst, he holds Master’s degrees in Anthropology from New York University and Education from Roberts Wesleyan College.

Invest in the Balanced Fund

°Green Century Capital Management, Inc. (Green Century) is the investment advisor to the Green Century Funds (the Funds).

1As of March 31, 2024, green and sustainable bonds comprised 73.32% of total bonds held in the Green Century Balanced Fund.

The performance information provided on this website is past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. To obtain performance current to the most recent month-end, please call 1-800-93-GREEN. Performance includes the reinvestment of income dividends and capital gains distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information.

The holdings of the Balanced Fund may change due to ongoing management of the Fund. Please click here for current information regarding the Funds’ portfolio holdings. These holdings are subject to risk as described in the Funds’ Prospectus. References to specific investments should not be construed as a recommendation of a security by the Fund, its administrator, or the distributor.

[1] The Custom Balanced Index is comprised of a 60% weighting in the S&P Supercomposite 1500 Index (the S&P 1500 Index) and a 40% weighting in the BofA Merrill Lynch 1-10 Year US Corporate & Government Index (the BofA Merrill Lynch Index). The S&P 1500 Index is an unmanaged index of 1500 selected stocks. The BofA Merrill Lynch Index tracks the performance of U.S. dollar-denominated investment grade government and corporate public debt issued in the U.S. domestic bond market with at least 1 year and less than 10 years remaining maturity, including U.S. treasury, U.S. agency, foreign government, supranational and corporate securities. It is not possible to invest directly in the Custom Balanced Index.

You should carefully consider the Funds' investment objectives, risks, charges and expenses before investing. To obtain a Prospectus that contains this and other information about the Funds, please click here for more information, email info@greencentury.com or call 1-800-934-7336. Please read the Prospectus carefully before investing.

Stocks will fluctuate in response to factors that may affect a single company, industry, sector, country, region or the market as a whole and may perform worse than the market. Foreign securities are subject to additional risks such as currency fluctuations, regional economic and political conditions, differences in accounting methods, and other unique risks compared to investing in securities of U.S. issuers. Bonds are subject to risks including interest rate, credit, and inflation.

The Green Century Funds are distributed by UMB Distribution Services, LLC., 235 W Galena Street, Milwaukee, WI 53212.