Investment Strategy

The Green Century Funds avoids environmentally dangerous industries and instead invests in companies that meet high environmental, social and governance (ESG) criteria. The Funds use the following strategies to pursue competitive returns.

Fossil Fuel Free

Green Century Funds is one of the first families of fossil fuel free environmentally responsible mutual funds in the U.S. The Green Century Funds had the foresight to avoid coal and major oil companies from its inception in 1991, providing a long track record of avoiding these environmentally dangerous industries.

Our exclusions are thorough. The Green Century Funds avoid:

- Exploration, extraction, processing, refining, and transmission of coal, oil, and gas

- Utilities that burn fossil fuels to produce electricity

- Companies with carbon reserves

Read more about the reasons to invest fossil fuel free to pursue a sustainable investment strategy on our fact sheet and download our guide The Future Can Be Bright: A Guide to Fossil Fuel Free and Sustainable Investing.

Green Century defines its standard for environmentally responsible and sustainable as seeking to provide an opportunity to invest in a way that avoids environmentally dangerous industries which impose onerous costs on society and the planet.

Environmentally Responsible Screens

The Green Century Funds believes that investors should have the option to avoid environmentally harmful industries and align their investments with their values. The Green Century Funds do not invest in companies that produce:

- Tobacco

- Genetically-Modified Organisms (GMOs)

- Nuclear Power

- Alcohol, Gambling, and Adult Entertainment

- Coal, Oil, or Gas

- Military, Conventional or Nuclear Weapons

Our exclusionary screens are included in our prospectus.

Environmental, Social and Governance (ESG) Criteria

All the Green Century Funds invest in companies that meet high ESG criteria.

A sustainable investment strategy that incorporates environmental, social, and governance criteria may result in lower or higher returns than an investment strategy that does not include such criteria.

Learn more about what ESG does and does not mean in this clarifying piece written by Green Century Funds President Leslie Samuelrich.

Why Invest Fossil Fuel Free

Research from leading industry analysts suggests that strategically investing fossil fuel free may help shield investors from:

- Volatility of oil prices

- Decreased dividends due to capital expenditures on high-cost projects such as offshore and Arctic drilling

- Devalued or stranded carbon reserve assets

These concerns are just some of the reasons why Green Century Funds has a long-standing investing strategy of avoiding the worst polluting companies and instead seeks to invest in companies that have not driven climate change.

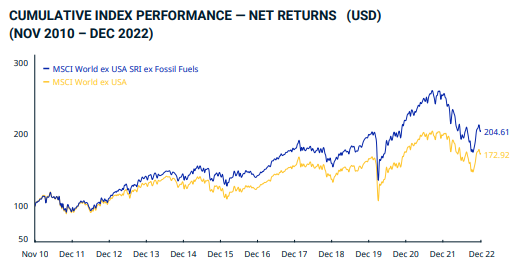

Source: MSCI World ex USA SRI ex Fossil Fuels Index (USD)

*See important disclosure information regarding MSCI ACWI ex Fossil Fuels and MSCI ACWI Index.

Past performance is not a guarantee of future results.

Avoid Greenwashing

As more investment strategies are marketed as “low carbon” or “climate change solutions,” keep these points in mind:

- “Low carbon” is not the same as fossil fuel free. Low carbon investments might invest in coal, oil, or gas companies; these portfolios might evaluate carbon emissions, carbon reserves, or the overall carbon footprint of an investment, but they may also still invest in the companies most responsible for climate change, such as fracking companies.

- Any binding exclusion, such as avoiding fossil fuel companies, should be spelled out in the prospectus. You can review the prospectus of the Green Century Funds here.

- Only portfolios with zero or “0.00%” in the energy sector would be consistent with fossil fuel free investments. Download our Fossil Free Investing Guide for additional guidance.

Additional Resources on Sustainable Investing

°Green Century Capital Management, Inc. (Green Century) is the investment advisor to the Green Century Funds (The Funds).

You should carefully consider the Funds' investment objectives, risks, charges and expenses before investing. To obtain a Prospectus that contains this and other information about the Funds, please click here for more information, email info@greencentury.com or call 1-800-934-7336. Please read the Prospectus carefully before investing.

Stocks will fluctuate in response to factors that may affect a single company, industry, sector, country, region or the market as a whole and may perform worse than the market. Foreign securities are subject to additional risks such as currency fluctuations, regional economic and political conditions, differences in accounting methods, and other unique risks compared to investing in securities of U.S. issuers. Bonds are subject to risks including interest rate, credit, and inflation. The Funds’ environmental criteria limit the investments available to the Funds compared to mutual funds that do not use environmental criteria. A sustainable investment strategy which incorporates environmental, social and governance criteria may result in lower or higher returns than an investment strategy that does not include such criteria; as a result performance could be affected.

The Green Century Funds are distributed by UMB Distribution Services, LLC., 235 W Galena Street, Milwaukee, WI 53212.