International Index Fund

Overview

The Green Century MSCI International Index Fund is one of the first fossil fuel free index funds available to U.S. investors. This passive fund affords individuals and institutions a way to invest their money internationally in an environmentally responsible way.

The Green Century MSCI International Index Fund is invested in the stocks of about 175 large- and mid-cap companies headquartered in 21 developed markets, including Japan, Germany, France, Canada, Switzerland, and 16 additional countries. The Fund does not invest in companies in the U.S. or emerging-markets countries.

Objective

The Green Century MSCI International Index Fund seeks to achieve long-term total return which matches the performance of an index comprised of the stocks of foreign companies selected based on environmental, social and, governance (ESG) criteria.

The International Index Fund seeks to achieve its objective by investing in the stocks of the companies included in the MSCI World ex USA SRI ex Fossil Fuels Index, a custom index calculated by MSCI, Inc. MSCI is a leading global index provider with which Green Century Funds has partnered for this Fund and the Green Century Equity Fund.

Investment Strategy

Exclusionary Screens: The International Index Fund does not invest in producers of GMOs (genetically modified organisms), guns and other civilian weapons, military weapons, nuclear energy, tobacco, alcohol, gambling, or coal, oil, and gas companies. These screens are included in our prospectus (PDF).

ESG criteria: The International Index Fund invests in companies MSCI calculates to have high Environmental, Social, and Governance criteria.

A sustainable investment strategy that incorporates environmental, social, and governance criteria may result in lower or higher returns than an investment strategy that does not include such criteria.

Index

The International Index Fund tracks the MSCI World ex USA SRI ex Fossil Fuels Index. This Index is composed of the common stocks of the approximately 240 companies in the MSCI World ex USA SRI Index customized to eliminate the stocks of companies that explore for, process, refine or distribute coal, oil, or gas, or produce or transmit electricity derived from fossil fuels, or have carbon reserves.

The composition of the International Index is reviewed annually and rebalanced quarterly. Companies are evaluated to determine if they have maintained their ESG performance and whether they remain part of the applicable MSCI universe.

Fund Facts

Inception Date:

September 30, 2016

Symbol and CUSIP:

Individual Investor Share Class: GCINX, 392768404

Institutional Investor Share Class: GCIFX, 392768503

Minimum Investment/Fund:

Individual Investor Share Class IRA Account: $1,000

Individual Investor Share Class Regular Account: $2,500

Institutional Share Class: $250,000

Sales Charge:

No Load Fund

Front End Load: None

Back End Load: None

12b-1 Fee: None

Expense Ratio:

Individual Investor Share Class: 1.28%

Institutional Share Class: 0.98%

Redemption Fee: 2.00% (on shares sold within 60 days of purchase)

Resources

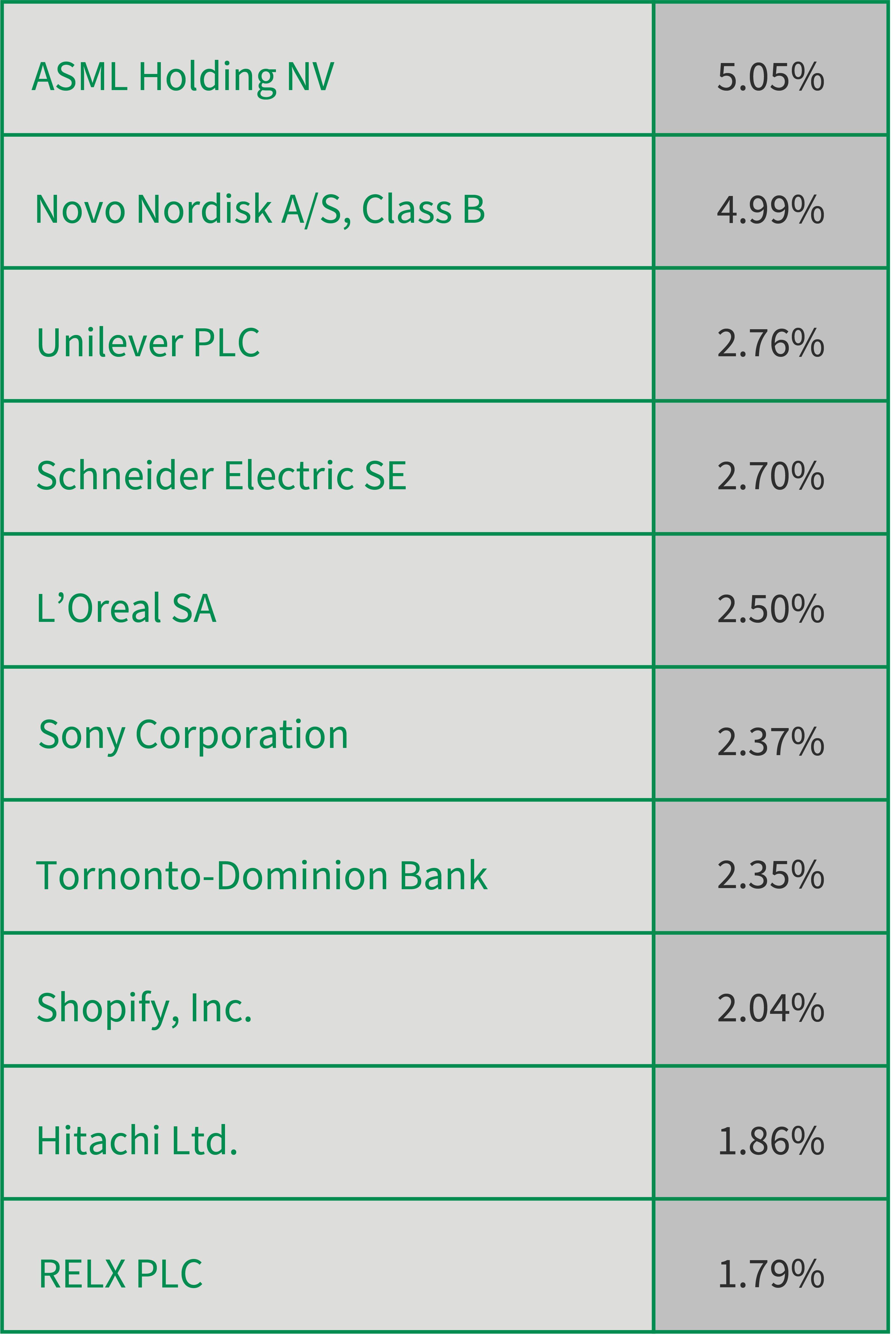

Portfolio Characteristics

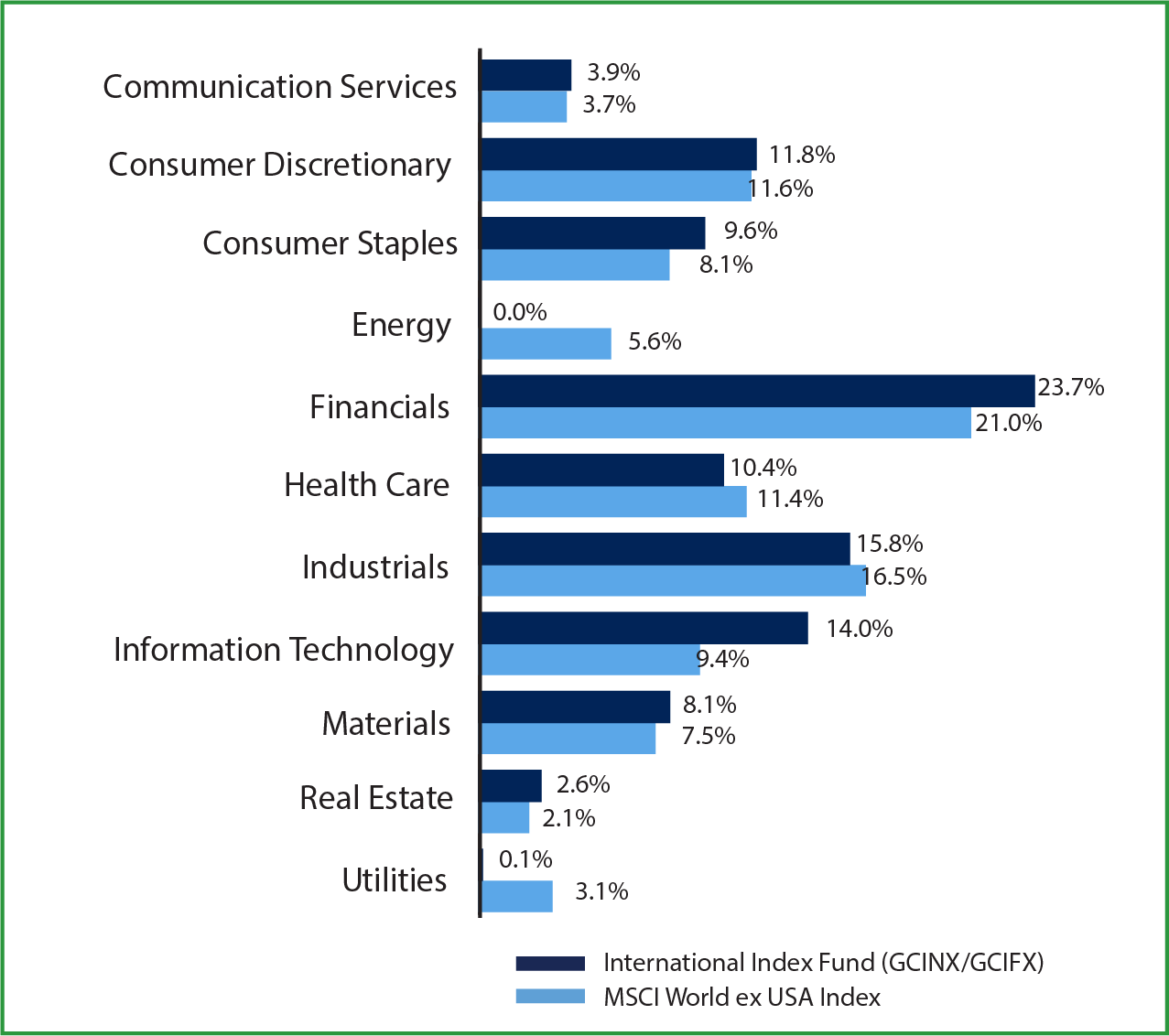

Sector Allocation

As of 3/31/24:

Asset Allocation

As of 3/31/24:

Total Net Assets: $204.84 million

Individual Investor Net Asset Value per Share: $14.04

Institutional Investor Net Asset Value per Share: $13.99

Common Stocks: 98.89%

Cash and Equivalents: 1.11%

Performance

Performance is calculated after fees.

The Individual Investor Share Class total expense ratio of the Green Century MSCI International Index Fund is 1.28% and the Institutional Share Class total expense ratio of the Fund is 0.98% as of the most recent prospectus.

The performance data quoted represents past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 1-800-93-GREEN. Performance includes the reinvestment of income dividends and capital gain distributions, if any. The performance shown does not reflect the deduction of taxes that a shareholder might pay on any Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus (PDF) for more information.

The Green Century International Index Fund seeks to track the MSCI World ex USA SRI ex Fossil Fuels Index. For more information about the MSCI World ex USA SRI ex Fossil Fuels Index click here.

Daily Fund Price as of 04/26/2024

| Fund | N.A.V. | $ Change |

|---|---|---|

| Green Century MSCI International Index Fund – Individual Investor Share Class (GCINX) | $13.60 | +$0.10 |

| Green Century MSCI International Index Fund – Institutional Share Class (GCIFX) | $13.55 | +$0.10 |

Portfolio Managers

Investment Advisor: Green Century Capital Management

Investment Sub-advisor and Portfolio Manager: Northern Trust Investments

International Index Provider: MSCI ESG Research

Green Century Funds provides the investment advisory services to the International Index Fund, including overseeing the daily portfolio management of the Fund by Northern Trust. Green Century Funds also coordinates the operations and the compliance functions for the Fund, as well as the shareholder advocacy efforts.

Northern Trust Investments is the sub-advisor to the International Index Fund providing day-to-day portfolio management of the Fund. The firm has managed socially responsible portfolios for more than 25 years and is a leading provider of investment management, asset and fund administration, banking solutions and fiduciary services for corporations, institutions and affluent individuals worldwide. Northern Trust, a financial holding company based in Chicago, has offices in 18 U.S. states and 16 international locations in North America, Europe, the Middle East and the Asia-Pacific region. For 120 years, Northern Trust has earned distinction as an industry leader in combining exceptional service and expertise with innovative products and technology.

MSCI is a leading provider of investment decision support tools to investors globally, including asset managers, banks, hedge funds and pension funds. MSCI products and services include indices, portfolio risk and performance analytics, and governance tools. The company’s flagship product offerings are: the MSCI indices which include over 148,000 daily indices covering more than 70 countries; Barra portfolio risk and performance analytics covering global equity and fixed income markets; RiskMetrics market and credit risk analytics; ISS governance research and outsourced proxy voting and reporting services; FEA valuation models and risk management software for the energy and commodities markets; and CFRA forensic accounting risk research, legal/regulatory risk assessment, and due-diligence. MSCI is headquartered in New York, with research and commercial offices around the world.

Steven Santiccioli

Vice President and Senior Portfolio Manager

Steven joined Northern Trust in 2003 and is now a Vice President for the company.

Prior to joining Northern Trust in 2003, Mr. Santiccioli was a portfolio manager with Deutsche Bank. Prior to his portfolio manager position at Deutsche, he served as the head of the accounting group for international index portfolios.

Mr. Santiccioli received a B.A. from Bucknell University and an M.B.A from Fordham University.

Brent D. Reeder

Senior Vice President

Head of US Index Equity Portfolio Management

Brent Reeder is a Senior Vice President and Head of US Equity Index Portfolio Management at The Northern Trust Company in Chicago. Prior to that experience, Brent was a Portfolio Manager in the Quantitative Management Group of Northern Trust Global Investments and was responsible for the management of index portfolios.

Brent has a broad range of expertise in both large capitalization and small capitalization index mandates. Before his investment management experience, Brent spent five years in trust operations as a team leader of the Foundations and Endowments team. He received a B.A. degree in Economics from DePauw University and an M.B.A. degree in Finance from DePaul University. Brent is an Associated Person with the National Futures Association.

Invest in the International Index Fund

°Green Century Capital Management, Inc. (Green Century) is the investment advisor to the Green Century Funds (the Funds).

The performance information provided on this website is past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. To obtain performance current to the most recent month-end, please call 1-800-93-GREEN. Performance includes the reinvestment of income dividends and capital gains distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information.

The holdings of the International Index Fund may change due to ongoing management of the Fund. Please click here for current information regarding the Funds’ portfolio holdings. These holdings are subject to risk as described in the Funds’ Prospectus. References to specific investments should not be construed as a recommendation of a security by the Fund, its administrator, or the distributor.

[1] The MSCI World ex USA Index is a custom index calculated by MSCI Inc. The MSCI World ex USA Index includes large and mid-cap stocks across 22 of 23 Developed Markets (DM) countries and excludes the United States. With 1,023 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI World ex USA Index is a free float-adjusted market capitalization index. It is not possible to invest directly in the MSCI World ex USA Index.

You should carefully consider the Funds' investment objectives, risks, charges and expenses before investing. To obtain a Prospectus that contains this and other information about the Funds, please click here for more information, email info@greencentury.com or call 1-800-934-7336. Please read the Prospectus carefully before investing.

Stocks will fluctuate in response to factors that may affect a single company, industry, sector, country, region or the market as a whole and may perform worse than the market. Foreign securities are subject to additional risks such as currency fluctuations, regional economic and political conditions, differences in accounting methods, and other unique risks compared to investing in securities of U.S. issuers. Bonds are subject to risks including interest rate, credit, and inflation.

As with all equity funds, the share price will fluctuate and may fall if the market as a whole declines or the value of the companies in which the Fund invests falls. The value of stocks held in the Fund will fluctuate in response to factors that may affect a single company, industry, market cap, country or region and may perform worse than the market. Foreign securities are subject to additional risks such as currency fluctuations, regional economic and political conditions, differences in accounting methods, and other unique risks compared to investing in securities of U.S. issuers. The Fund’s environmental criteria limit the investments available to the Fund compared to mutual funds that do not use environmental criteria; as a result performance could be affected.

The World ex USA SRI ex Fossil Fuels Index is a custom index calculated by MSCI Inc. The World ex USA SRI ex Fossil Fuels Index is comprised of the common stocks of the companies in the MSCI World ex USA SRI Index (the World ex USA SRI Index), minus the stocks of the companies that explore for, extract, produce, manufacture or refine coal, oil or gas or produce or transmit electricity derived from fossil fuels or transmit natural gas or have carbon reserves included in the World ex USA SRI (Socially Responsible Investment) Index. The World ex USA SRI Index includes large and mid-cap stocks from approximately 22 developed markets countries (excluding the U.S.). The World ex USA SRI Index is a capitalization weighted index that provides exposure to companies with what MSCI calculates to have outstanding Environmental, Social and Governance (ESG) ratings and excludes companies whose products have negative social or environmental impacts. It is not possible to invest directly in an index.

The Green Century MSCI International Index Fund (the “Fund”) is not sponsored, endorsed, or promoted by MSCI, its affiliates, information providers or any other third party involved in, or related to, compiling, computing or creating the MSCI indices (the “MSCI Parties”), and the MSCI Parties bear no liability with respect to the Fund or any index on which the Fund is based. The MSCI Parties are not sponsors of the Fund and are not affiliated with the Fund in any way. The Statement of Additional Information contains a more detailed description of the limited relationship the MSCI Parties have with Green Century Capital Management and the Fund.

The Green Century Funds are distributed by UMB Distribution Services, LLC., 235 W Galena Street, Milwaukee, WI 53212.